Keeping Records For Tax Purposes . How long to keep your records. Web keep records for 3 years if situations (4), (5), and (6) below do not apply to you. Web the importance of keeping records. Keep records for 3 years from the. The law requires every business to keep proper accounts and records. Web if you use information from a record in your tax return in one financial year and then use that information again in a future return,. 5 things to know about record keeping. Web good record keeping practices not only enable a company to reduce the cost and effort required to file tax returns and reply. Web in singapore, it is mandatory for companies to keep proper records of their financial transactions.

from db-excel.com

The law requires every business to keep proper accounts and records. 5 things to know about record keeping. Web the importance of keeping records. Keep records for 3 years from the. Web if you use information from a record in your tax return in one financial year and then use that information again in a future return,. Web keep records for 3 years if situations (4), (5), and (6) below do not apply to you. How long to keep your records. Web good record keeping practices not only enable a company to reduce the cost and effort required to file tax returns and reply. Web in singapore, it is mandatory for companies to keep proper records of their financial transactions.

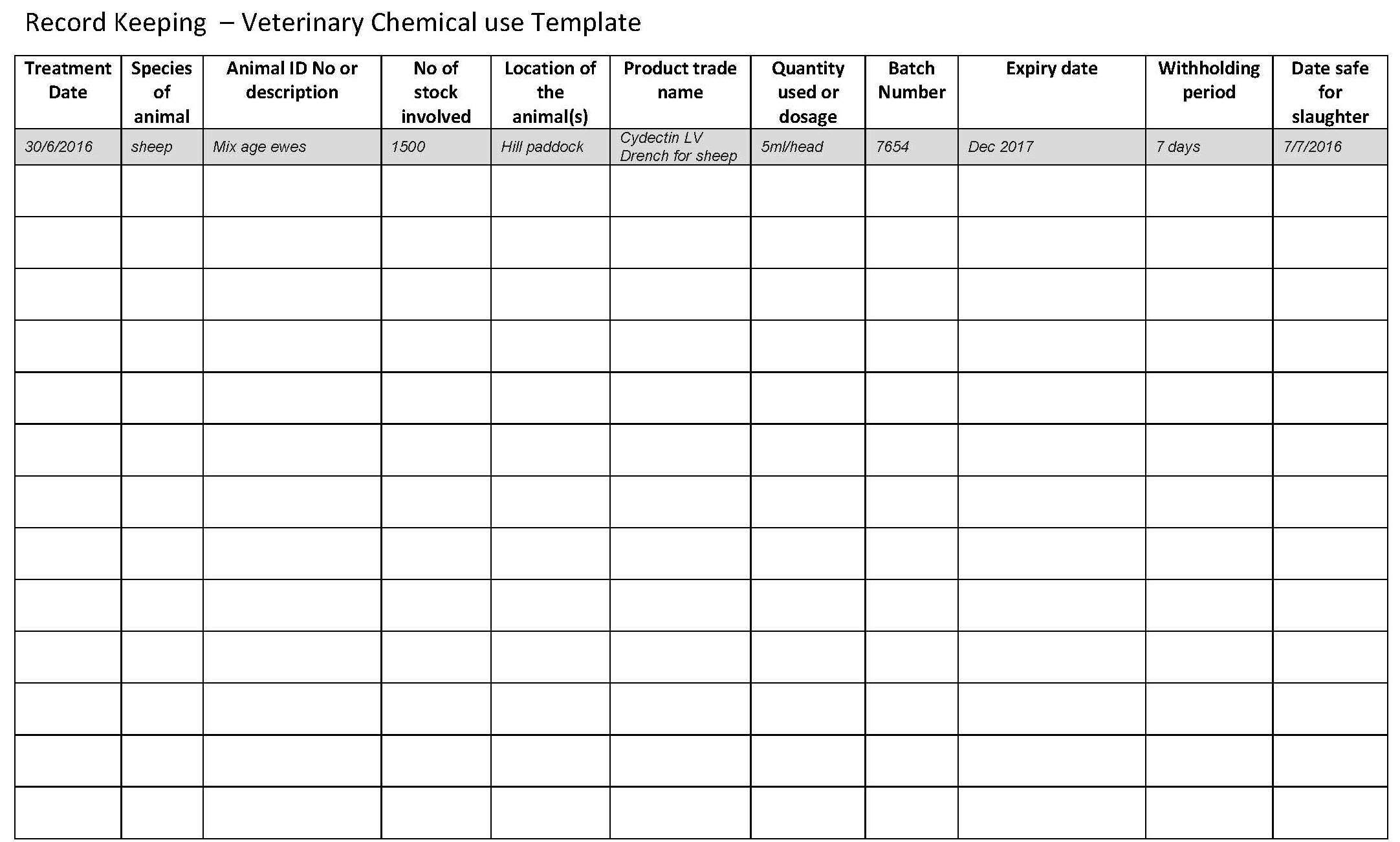

Record Keeping Template For Small Business And Bookkeeping Records

Keeping Records For Tax Purposes Web good record keeping practices not only enable a company to reduce the cost and effort required to file tax returns and reply. Web in singapore, it is mandatory for companies to keep proper records of their financial transactions. Web if you use information from a record in your tax return in one financial year and then use that information again in a future return,. Keep records for 3 years from the. How long to keep your records. Web good record keeping practices not only enable a company to reduce the cost and effort required to file tax returns and reply. Web keep records for 3 years if situations (4), (5), and (6) below do not apply to you. 5 things to know about record keeping. Web the importance of keeping records. The law requires every business to keep proper accounts and records.

From www.pinterest.com

This record retention schedule guides you how long to keep records for Keeping Records For Tax Purposes Web in singapore, it is mandatory for companies to keep proper records of their financial transactions. Web the importance of keeping records. Web if you use information from a record in your tax return in one financial year and then use that information again in a future return,. Web keep records for 3 years if situations (4), (5), and (6). Keeping Records For Tax Purposes.

From www.innovationtax.co.uk

Recordkeeping requirements for claiming R&D Tax Credits Innovation Tax Keeping Records For Tax Purposes Web the importance of keeping records. Web good record keeping practices not only enable a company to reduce the cost and effort required to file tax returns and reply. 5 things to know about record keeping. Web keep records for 3 years if situations (4), (5), and (6) below do not apply to you. Web in singapore, it is mandatory. Keeping Records For Tax Purposes.

From legalshred.com

Tax Record Retention How Long to Keep Tax Records? Legal Shred Keeping Records For Tax Purposes Web good record keeping practices not only enable a company to reduce the cost and effort required to file tax returns and reply. Web if you use information from a record in your tax return in one financial year and then use that information again in a future return,. The law requires every business to keep proper accounts and records.. Keeping Records For Tax Purposes.

From www.youtube.com

I HATE RECORD KEEPING! Simple and EASY Ways to Keep Up with Taxes and Keeping Records For Tax Purposes How long to keep your records. Web the importance of keeping records. Web in singapore, it is mandatory for companies to keep proper records of their financial transactions. Web keep records for 3 years if situations (4), (5), and (6) below do not apply to you. Web if you use information from a record in your tax return in one. Keeping Records For Tax Purposes.

From www.bench.co

Expense Trackers The Top 6 Tools For Small Businesses Bench Accounting Keeping Records For Tax Purposes Web keep records for 3 years if situations (4), (5), and (6) below do not apply to you. The law requires every business to keep proper accounts and records. 5 things to know about record keeping. Web in singapore, it is mandatory for companies to keep proper records of their financial transactions. Keep records for 3 years from the. Web. Keeping Records For Tax Purposes.

From www.findabusinessthat.com

How Long to Keep Business Records Before Shredding Them Keeping Records For Tax Purposes 5 things to know about record keeping. How long to keep your records. Web keep records for 3 years if situations (4), (5), and (6) below do not apply to you. Web good record keeping practices not only enable a company to reduce the cost and effort required to file tax returns and reply. The law requires every business to. Keeping Records For Tax Purposes.

From accrumelb.com.au

How long do you need to keep your tax records for? Our expert advice! Keeping Records For Tax Purposes How long to keep your records. Web if you use information from a record in your tax return in one financial year and then use that information again in a future return,. Web the importance of keeping records. Keep records for 3 years from the. Web in singapore, it is mandatory for companies to keep proper records of their financial. Keeping Records For Tax Purposes.

From www.jmbfinmgrs.com

Record Retention Guidelines for Business Owners JMB Financial Managers Keeping Records For Tax Purposes Web in singapore, it is mandatory for companies to keep proper records of their financial transactions. Keep records for 3 years from the. The law requires every business to keep proper accounts and records. Web if you use information from a record in your tax return in one financial year and then use that information again in a future return,.. Keeping Records For Tax Purposes.

From gbu-taganskij.ru

How To Keep A Mileage Log To Claim Vehicle Expenses, 48 OFF Keeping Records For Tax Purposes How long to keep your records. Web keep records for 3 years if situations (4), (5), and (6) below do not apply to you. Web in singapore, it is mandatory for companies to keep proper records of their financial transactions. 5 things to know about record keeping. Web if you use information from a record in your tax return in. Keeping Records For Tax Purposes.

From www.pandle.com

Keeping Records for Making Tax Digital VAT Pandle Keeping Records For Tax Purposes Web if you use information from a record in your tax return in one financial year and then use that information again in a future return,. How long to keep your records. Web keep records for 3 years if situations (4), (5), and (6) below do not apply to you. 5 things to know about record keeping. The law requires. Keeping Records For Tax Purposes.

From tmdaccounting.com

How to Prepare Tax Records for Your Accountant TMD Accounting Keeping Records For Tax Purposes Web if you use information from a record in your tax return in one financial year and then use that information again in a future return,. 5 things to know about record keeping. Keep records for 3 years from the. Web good record keeping practices not only enable a company to reduce the cost and effort required to file tax. Keeping Records For Tax Purposes.

From www.youtube.com

How to Record Sales Tax Payable and Estimated Taxes in QB (Part 6 Video Keeping Records For Tax Purposes 5 things to know about record keeping. How long to keep your records. Keep records for 3 years from the. Web in singapore, it is mandatory for companies to keep proper records of their financial transactions. The law requires every business to keep proper accounts and records. Web if you use information from a record in your tax return in. Keeping Records For Tax Purposes.

From www.finansdirekt24.se

How Long to Keep Payroll Records finansdirekt24.se Keeping Records For Tax Purposes The law requires every business to keep proper accounts and records. Web good record keeping practices not only enable a company to reduce the cost and effort required to file tax returns and reply. 5 things to know about record keeping. Web if you use information from a record in your tax return in one financial year and then use. Keeping Records For Tax Purposes.

From db-excel.com

Record Keeping Template For Small Business And Bookkeeping Records Keeping Records For Tax Purposes Web the importance of keeping records. Web in singapore, it is mandatory for companies to keep proper records of their financial transactions. The law requires every business to keep proper accounts and records. 5 things to know about record keeping. Web good record keeping practices not only enable a company to reduce the cost and effort required to file tax. Keeping Records For Tax Purposes.

From www.laukamcguire.com

Portland Area Certified Public Accountants Records Retention Guidelines Keeping Records For Tax Purposes Web good record keeping practices not only enable a company to reduce the cost and effort required to file tax returns and reply. The law requires every business to keep proper accounts and records. How long to keep your records. Web if you use information from a record in your tax return in one financial year and then use that. Keeping Records For Tax Purposes.

From www.vrogue.co

Tax Deductions Log Printable Moderntype Designs vrogue.co Keeping Records For Tax Purposes Web the importance of keeping records. The law requires every business to keep proper accounts and records. Web good record keeping practices not only enable a company to reduce the cost and effort required to file tax returns and reply. 5 things to know about record keeping. Web if you use information from a record in your tax return in. Keeping Records For Tax Purposes.

From www.zasio.com

How Long Do You Keep Your Tax Records? Zasio Enterprises Keeping Records For Tax Purposes Web the importance of keeping records. Web keep records for 3 years if situations (4), (5), and (6) below do not apply to you. How long to keep your records. Web in singapore, it is mandatory for companies to keep proper records of their financial transactions. 5 things to know about record keeping. Web if you use information from a. Keeping Records For Tax Purposes.

From www.gaylortaxservices.com

Top Tips for Keeping Good Tax Records Gaylor Tax Services, LLC Keeping Records For Tax Purposes 5 things to know about record keeping. Web in singapore, it is mandatory for companies to keep proper records of their financial transactions. Web if you use information from a record in your tax return in one financial year and then use that information again in a future return,. Web the importance of keeping records. Web keep records for 3. Keeping Records For Tax Purposes.